when are draftkings tax forms available

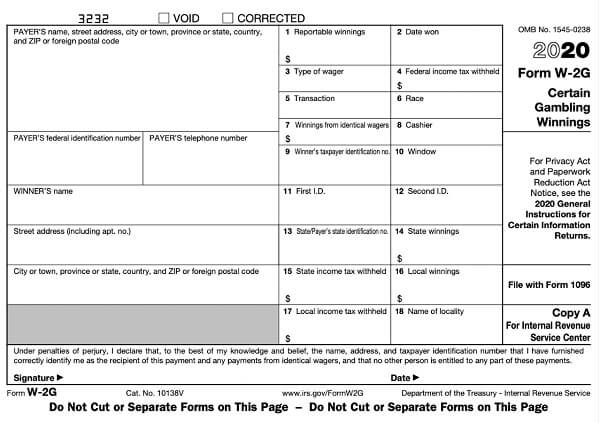

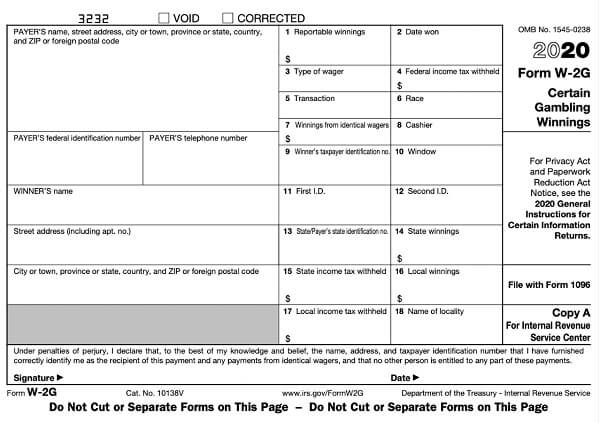

Key tax dates for DraftKings - 2021 Forms 1099-MISC and Forms W-2G will become available online prior to the end of February IRS extended due date. Fan Duel sent me mine via e-mail about a week ago.

Draftkings Sportsbook And Casino Pa How To Play And Get 1 500 Free

If you dont need to itemize you dont get it.

. Draftkings sportsbook users can wager on the vast majority of teams sports and events. I recently deposited about 50 in DraftKings and have grown that amount to around 800 mostly luck. If you qualify to receive tax forms from DraftKings IRS Forms 1099W-2G you can access the information directly from the Document Center.

DraftKings tax withdrawal question for those that know. FanDuel sent me a tax form just the other day dont use draftkings so Im not sure how they go about it. A separate communication will be sent to players receiving tax forms once they are available for download in the DraftKings Document Center accessible via the DraftKings website.

Click to see full answer. Draft a new lineup whenever you want. Discussion in MMA Betting Discussion started by matthew55 Oct 25 2020.

For Oregon activity please contact the DraftKings Customer Support team as the information in this article may not apply to you. Pick from your favorite stars each week. If your net earnings were 600 and are expecting a 1099 but have not received a hard copy of your form in the mail you can access this from the website both via desktop or mobile device for your tax record purposes.

Andor appropriate tax forms and forms of identification including but not limited to a Drivers License Proof of Residence andor any information. However if you havent received yours dont worry. Ive never needed one from Draft Kings so not sure on that front.

Play in a public contest and against friends in a private league. Quickly enter a contest any time before the lineup lock. Beginning with tax year 2022 if someone receives payment for goods and services through a third- party payment network their income will be reported on Form 1099-K if 600 or more was processed as opposed to the current Form 1099-K reporting requirement of 200 transactions and 20000.

Its basically a legal document saying you are giving the. So if I have 1200 in wins but 400 in losses I will be taxed on the 1200 unless I itemize on. It is a very simple form and its more to cover THEIR asses than yours.

The Fan Duel one was nice because they had already subtracted my deposits from my. You should attach the schedule 1 form to your form 1040. After some doing research on my own is it correct that I will be taxed on the gain of each individual win.

We are regulated by the New Jersey Division of Gaming Enforcement as an Internet gaming operator in accordance with the Casino Control Act NJSA. Players who believe that funds held by or their accounts with DraftKings Inc. This form is located under the Tax Information tab via the Avatar drop down at the top right hand corner of the webpage.

Users will be able to visit the Website and view the games eg sportsbook and casino offered by DraftKings and available to play and place a wager the Game or collectively the Games. DraftKings at Casino Queen shall use commercially reasonable efforts to process requests for withdrawal within fourteen 14 days of DraftKings at Casino Queens receipt from the user of any tax reporting paperwork or other information reasonably required by DraftKings at. You report winnings and then losses are itemized.

Have been misallocated compromised or otherwise mishandled may register a complaint with DraftKings Inc. Win cash prizes weekly paid out as soon as the contest ends. You can expect to receive your tax forms no later than February 28.

That number then goes on your us. Draftkings sportsbook tax form. There is another way you can get hold of it- online at the DraftKings Document Center.

We should mention that most bettors should have received their DraftKings 1099 forms in the mail after February 1st. Jul 16 2017 Messages.

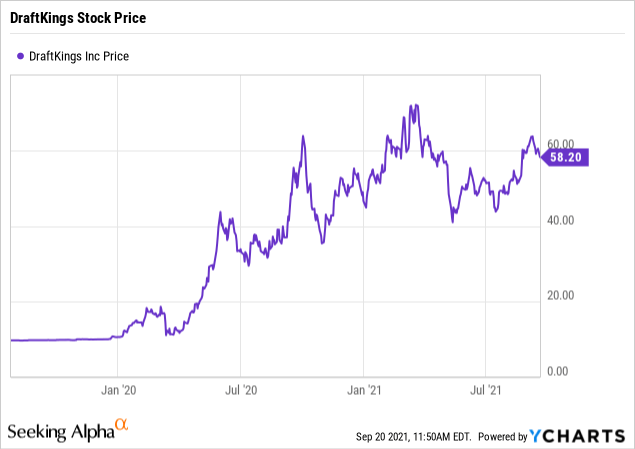

Is Draftkings Dkng Stock A Buy Or Sell As The Nfl Season Starts Seeking Alpha

Draftkings Online Sportsbook App Review Best Offers In Ny La Az

How To Make A Draftkings Deposit Banking Methods Options

Tm2021918 3 S1 None 62 9594488s

N Y Sportsbooks Limit Promos Ask For Tax Breaks As Losses Rise Bnn Bloomberg

Draftkings Fanduel Legal States Where Is Dfs Allowed

Draftkings Don T Chase The Post Earnings Rally Investing Com

Draftkings Stock Sinks 20 Amid Skepticism About Long Term Profitability

Draftkings Tumbles After Forecasting Wider Losses In 2022 Financial Times

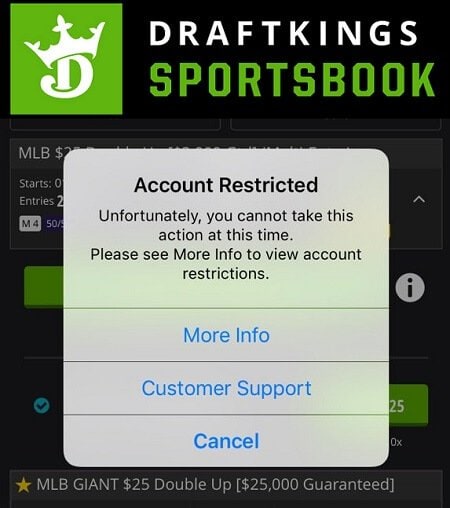

Restore Restricted Or Locked Draftkings Sportsbook Account

Draftkings Tumbles After Forecasting Wider Losses In 2022 Financial Times

/cdn.vox-cdn.com/uploads/chorus_asset/file/22778751/DK_Nation_1800x1200_6.png)

Nft Explained What Are Nfts And How Do They Work In The Draftkings Marketplace Draftkings Nation

Draftkings Sportsbook Iowa 2022 Promo Code For Up To 1 050

:max_bytes(150000):strip_icc()/DKNG-Chart-10122020-9f479c0043f6403ea08f99eeaa4b863e.png)

Draftkings Dkng Could Rebound On Analyst Bullishness

Draftkings Tax Form 1099 Where To Find It How To Fill

Draftkings Daily Fantasy Sports 500 Bonus On Dfs Basketball Insiders Nba Rumors And Basketball News

Draftkings Tax Form 1099 Where To Find It How To Fill

Draftkings Sportsbook Florida 2022 Promotions And Preview

Play Draftkings Or Fanduel The Irs Wants To Know About Your Winnings Nasdaq