vermont department of taxes homestead declaration

Injured Spouse Unit PO Box 1645 Montpelier VT 05601-1645 The Department will notify you if the property tax credit is taken to pay a bill. 5401 5401.

Vermont Tax Forms And Instructions For 2021 Form In 111

A Vermont homestead is the principal dwelling and parcel of land surrounding the dwelling owned and occupied by a resident individual as the individuals domicile on April 1.

. Homestead Declaration Each person who owns property and lives on that property must declare homestead this year by April 18th. Vermont Department of Taxes ATTN. If you do not file by this date then you will receive a penalty.

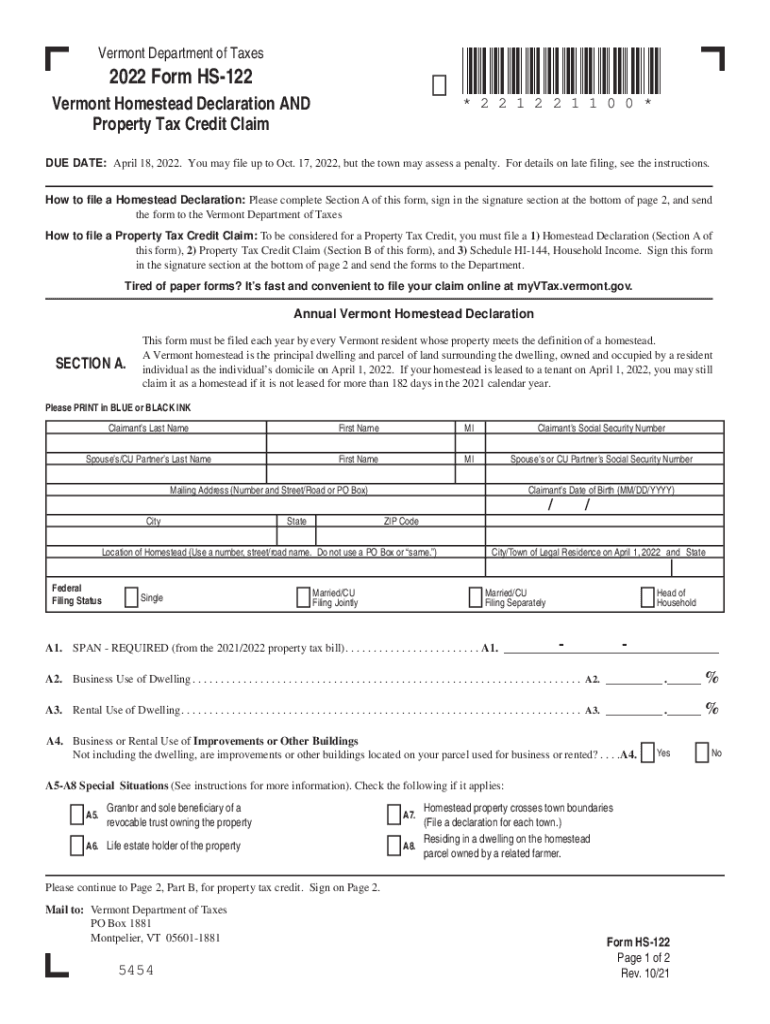

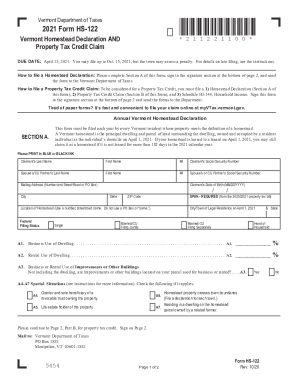

Annual Vermont Homestead Declaration This form must be filed each year by every Vermont resident whose property meets the definition of a homestead. If your property fulfills the criteria to be declared a homestead you can file a Vermont homestead declaration and property tax adjustment every year. Tax Year 2021 Instructions HS-122 HI-144 Vermont Homestead Declaration AND Property Tax Credit Claim.

All groups and messages. The Vermont Statutes Online Title 32. Mon 01242022 - 1200.

Montpelier Vt The Vermont Department of Taxes 5102021. Vermont Department of Taxes. The Homestead Declaration is filed using Form HS-122 the Homestead Declaration and Property Tax Credit Claim.

Use the Cross or Check marks in the top toolbar to select your answers in the list boxes. You can download or print current or past-year PDFs of Form HS-122 HI-144 directly from TaxFormFinder. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

BUYING AND SELLING PROPERTY Buying on or before April 1 2022 If you buy the property that you will use as your principal home you are responsible for filing a 2022 homestead declaration on this property by the due date. You are the owner or co-owner of the property The property is your primary residence as of April 1 each year. Taxation and Finance Chapter 135.

Vermont Department of Taxes PO Box 1779. Ad Edit Fill eSign PDF Documents Online. 1 Coefficient of dispersion is the average absolute deviation expressed as a percentage of the median ratio and for a municipality in any school year shall be determined by the Director of.

Instantly Find and Download Legal Forms Drafted by Attorneys for Your State. Information on upcoming tax filing deadlines and these programs is available on the departments website at taxvermontgov. If you file a paper form it is important to remember to sign the form at the bottom of the Page 1 of 2.

You can print other Vermont tax forms here. The definition of a homestead is as follows. Vermont Income Tax Return.

Check Return or Refund Status Pay Your Taxes. 802-828-2865 or toll free in Vermont 866-828-2865 on Monday Tuesday Thursday and Friday from 745 am to 430 pm. Best PDF Fillable Form Builder.

If your homestead is leased to a tenant on April 1 2022 you may still claim it as a homestead if it is not leased for more than 182 days in the 2021 calendar year. Go Paperless Fill Sign Documents Electronically. As used in this chapter.

More Fillable Forms Register and Subscribe Now. Individual as the individuals domicile on April 1 2022. Start completing the fillable fields and carefully type in required information.

Ad CA Homestead decl. Homestead Declaration and Property Tax Credit Filing Department of Taxes Use myVTax the departments online portal to e-file Form HS-122 Homestead Declaration and Property Tax Credit and Schedule HI-144 Household Income with the Department of Taxes. Cashiers check or money order payable to the Vermont Department of Taxes.

We last updated the Homestead Declaration AND Property Tax Adjustment Claim in March 2022 so this is the latest version of Form HS-122 HI-144 fully updated for tax year 2021. EDUCATION PROPERTY TAX Cite as. Tax examiners in this division can answer questions about Vermont personal income tax Homestead Declaration Property Tax Adjustment Claim and Renter Rebate Claim.

Taxpayers having trouble filing Homestead Declarations and Property Tax Credit Claims may call 802 828-2865 for help. PA-1 Special Power of Attorney. Vermont Homestead Declaration AND.

Use Get Form or simply click on the template preview to open it in the editor. You have 30 days from the date on the notice to submit the injured spouse claim. The easiest and quickest way to file is electronically on the Departments website at myVTax.

Homestead Declaration and Property Tax Adjustment Filing Vermontgov Freedom and Unity Use myVTax the departments online portal to e-file Form HS-122 Homestead Declaration and Property Tax Adjustment Claim and Schedule HI-144 Household Income with the Department of Taxes. Use the housesite value found on the 20212022 property tax bill of the property you own and occupy on April 1 2022. Quick steps to complete and e-sign Vt homestead declaration online.

W-4VT Employees Withholding Allowance Certificate. Even if you do not believe you owe property taxes you must declare homestead in order to qualify for Property Tax Adjustment.

Individuals Department Of Taxes

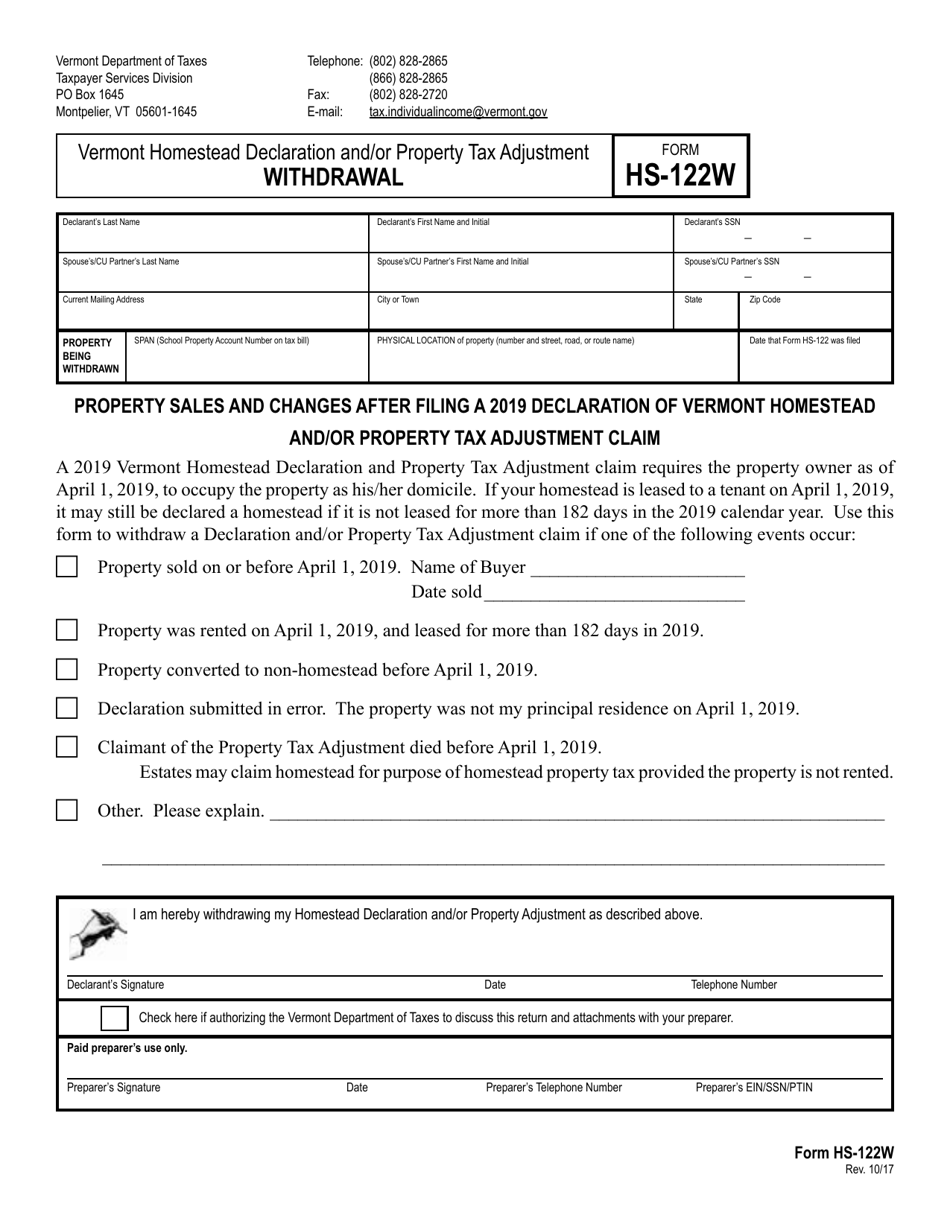

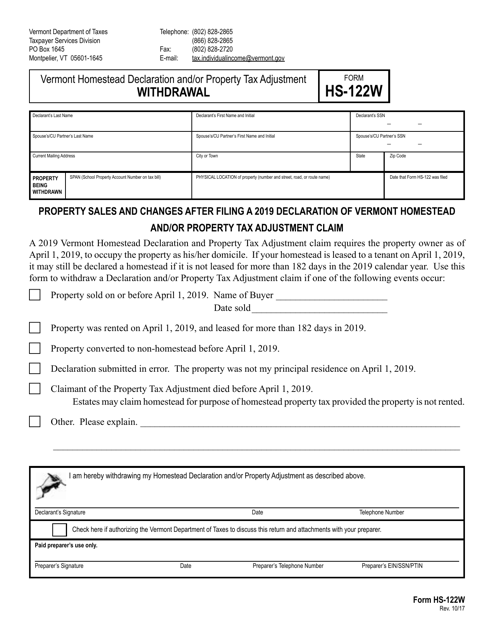

Vt Form Hs 122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration And Or Property Tax Adjustment Withdrawal Vermont Templateroller

Vt Form Hs 122 2022 Fill And Sign Printable Template Online Us Legal Forms

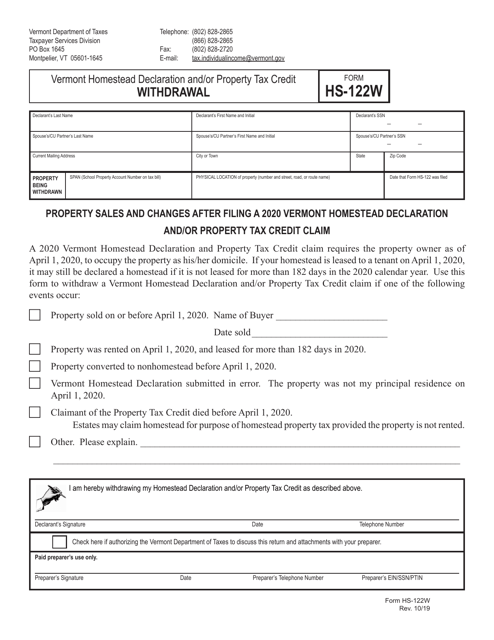

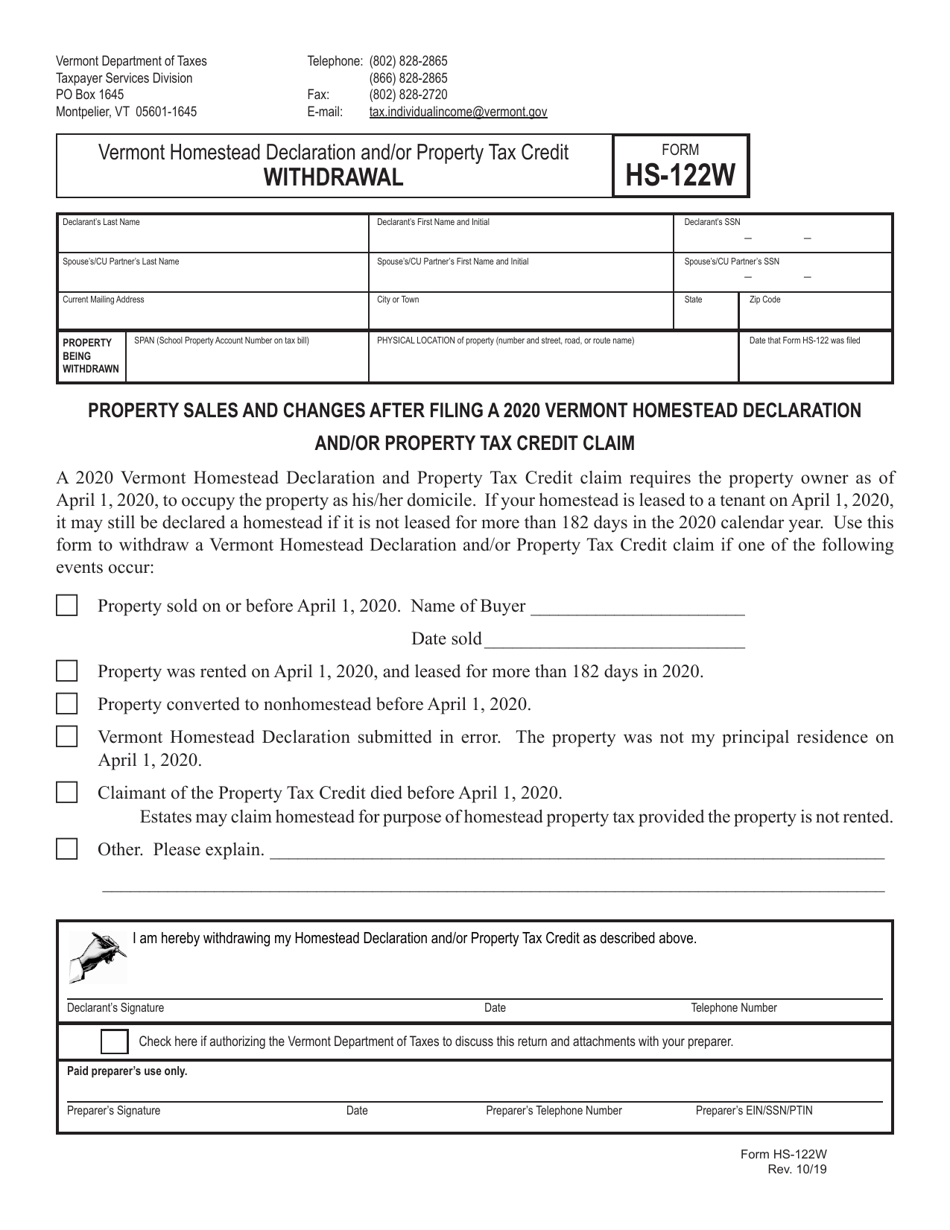

Form Hs 122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration And Or Property Tax Credit Withdrawal 2020 Vermont Templateroller

Vermont Department Of Taxes Youtube

How To File A Renter Credit Claim In Myvtax Form Rcc 146 V4 Youtube

Form Hs 122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration And Or Property Tax Credit Withdrawal 2020 Vermont Templateroller

Vt Form Hs 122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration And Or Property Tax Adjustment Withdrawal Vermont Templateroller

Vermont Hi 144 Form Fill Out And Sign Printable Pdf Template Signnow

Download Instructions For Form Hs 122 Vermont Homestead Declaration And Property Tax Credit Pdf 2020 Templateroller